By: Mark Cudmore, Bloomberg Markets

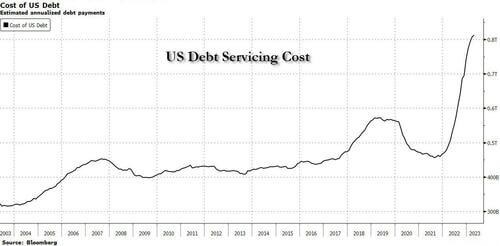

Thanks to rising yields, the US government now has to spend more each year on servicing its immense debt burden than it spent on national defense in 2022.

The calculation is based on estimated annualized debt payments as of end of April versus the Treasury’s release of last year’s budget expenditures.

If you want one stat to sum up why debt-ceiling negotiations are so fraught this time around, making them both harder to conclude and yet more important for markets, this is probably it. Estimated annualized debt-servicing costs are about 90% higher than they were back in 2011. This is partially due to an exploding debt pile, but also due to a significant shift higher in US yields.

In 2022, based on how the Treasury breaks down line items, the US government only spent more on social security ($1,244b) and health ($909b), with income security in line with today’s debt-servicing costs at $813b.