By: Scott McClallen | The Center Square

A security expert says Congress should reduce food stamp fraud as it faces a Saturday deadline to renew the Farm Bill.

Haywood Talcove is the CEO of LexisNexis Risk Solutions' Government Group, which provides fraud prevention tools to 26 state unemployment programs and 50 U.S. banks.

He says about 20% of the Supplemental Nutrition Assistance Program’s $127 billion annual budget, or $25 billion annually, is likely lost to criminals.

During the pandemic, criminals defrauded the Paycheck Protection Program and state unemployment insurance programs. Now, Talcove said criminals target food stamps, a U.S. Department of Agriculture program providing a social safety net to about 40 million people “at scale” and is likely taking between $24 billion and $36 billion annually.

“The problem is these legitimate recipients are getting their cards stolen … and it’s not their fault because the processes and systems put into place by USDA aren’t working,” Talcove told The Center Square. “It can take a ton of time to get your money back.”

Talcove said the scheme preys on the “most needy and vulnerable part of our population” and could be avoided by replacing point-of-sale terminals and electronic benefit transfer cards with a chip-enabled option.

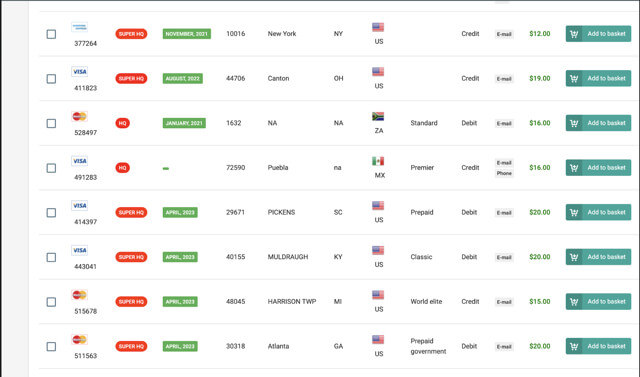

A website offers SNAP cards for sale, which are meant to feed vulnerable people. Haywood Talcove

A USDA spokesman said the Food and Nutrition Services can't currently estimate national fraud but said national skimming data should be published later this year.

"FNS lacks sufficient data at this time to produce a reliable national estimate for skimming,” the spokesman wrote in an email. “Thanks to authority enacted by Congress in the Omnibus, states are now required to collect data on the scope and frequency of card skimming and report regularly to FNS. This will help states, FNS and Congress better understand the magnitude of card skimming.”

In December, Congress allowed the replacement of stolen SNAP benefits via card skimming and cloning between Oct. 1, 2022, and Sept. 30, 2024.

Michigan Department of Health and Human Services spokeswoman Lynn Sutfin said that FNS and some states are piloting chipped cards.

“We expect to hear more information after the pilot is completed,” Sutfin wrote in an email. “There are currently no federal funds available for chipped cards.”

In March, USDA piloted SNAP mobile contactless payments by scanning or tapping a cellphone in Illinois, Louisiana, Massachusetts, Missouri and Oklahoma.

In fiscal year 2023, FNS offered $5 million in grants for states to detect fraud. But Talcove says because of lackadaisical security, “USDA is one of the largest funders of cyber fraud in the world.”

For example, the owner of Big Daddy’s Meat Market in Atlanta last week pleaded guilty to a $10 million scheme paying customers to redeem SNAP benefits at 50 cents on the dollar between 2015 and 2020.

Criminals also burn the retailer's SNAP number, similar to a Social Security number so the USDA knows it's a legitimate vendor, onto a point of sale terminal and sells it on the dark web.

Then, criminals skim electronic banking cards through the stolen terminal so the transactions appear from a legitimate retailer such as Walmart, Sam’s Club, B.J’s Wholesale Club or Target.

Talcove said he hopes Congress improves the program, citing data that 71% of Americans want eligibility requirements enforced.