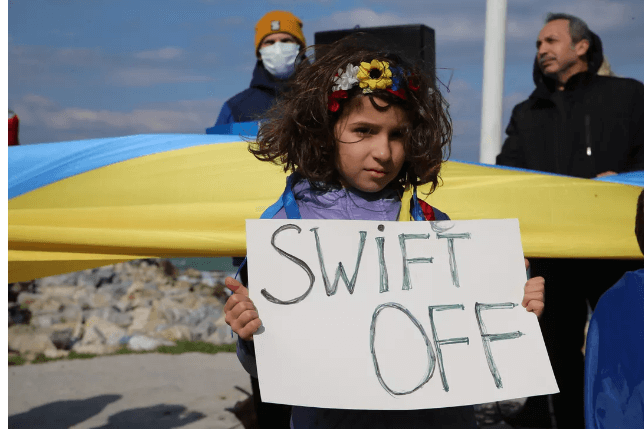

As the Russian invasion of Ukraine continues, the European Union and US have ratcheted up pressure on Russia with a joint statement declaring that "selected Russian banks" will be kicked off the Swift international payments system.

Russia's attacks on Ukraine have prompted the US and other countries around the world to impose economic penalties on the country and President Vladimir Putin, personally. While some European countries were originally opposed to removing Russian banks from Swift, the military action of the past week has changed their calculations.

The removal of Russian banks from the Swift system has been called the "financial nuclear option" by French Finance Minister Bruno Lemaire. Other experts suggest that the ban from Swift will have less of an effect on Russia than economic sanctions like freezing funds or banning imports.

Read on to learn more about Russia's expulsion from Swift and what effects the decision could have on the country and the rest of the world.

For more on the Russian invasion of Ukraine, see how the military conflict could affect the US economy and gas prices, learn how Twitter and Facebook are cracking down on Russia, and discover how misinformation about the Ukraine-Russian war proliferates on social media.

What is Swift?

Swift stands for the Society for Worldwide Interbank Financial Telecommunication, a cooperative society created in Belgium in 1973. The organization bills itself as "the global provider of secure financial messaging services."

Swift isn't a traditional financial institution -- it doesn't manage accounts for individuals or banks, and it doesn't hold any third-party funds. Swift simply acts as the messaging system for international payments. The Washington Post has described it as "the Gmail of global banking."

The organization runs its own financial messaging network called SWIFTnet, which provides secure, standardized communication services and software to banks, brokers and investment firms. According to Swift, the network includes more than 11,000 financial institutions worldwide and transmitted 42 million messages a day in 2021.

Read More

Sign Up for Lisa's Top Ten to get a daily briefing on the world each morning.

Start your free trial today.